Triple-column Comparison between Modern Monetary Theory (MMT), the Actual Monetary System, and Sovereign Monetary Reform (SMR)

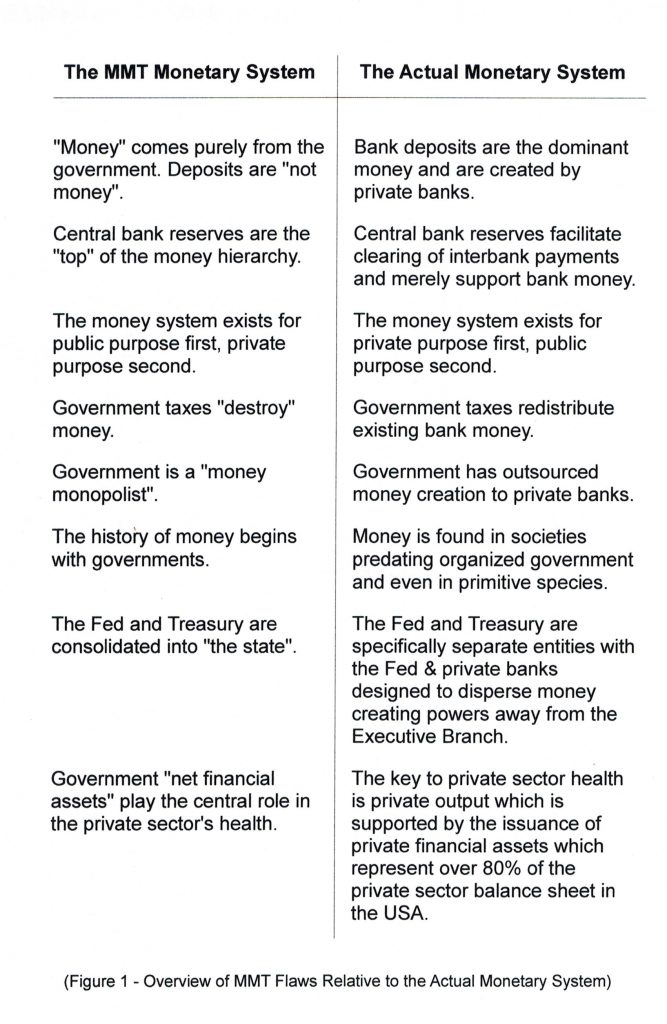

A while ago I found a very useful double-column comparison of the concept of the monetary system in Modern Monetary Theory (MMT) and how the monetary system actually functions. The figure is titled:

“Overview of MMT Flaws Relative to the Actual Monetary System”

It is a small image easily used on-line in posts and discussions and was composed by Cullen Roche in a 2013 article titled “A Critique of Modern Monetary Theory (MMT)“. Roche is the author of Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance and editor of the eponymous web site Pragmatic Capitalism.

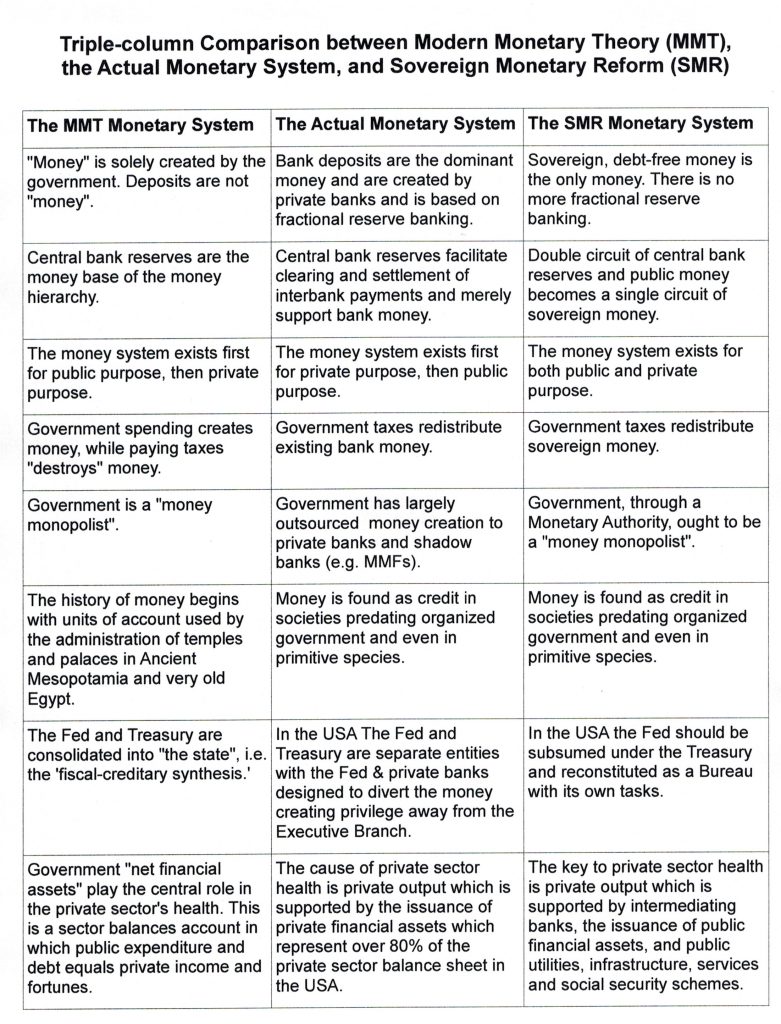

Recently I had the idea to expand the double column into a triple one by adding the ideas and proposals by the movement proposing Sovereign Money Reform (SMR) based on what Dr. Joseph Huber calls New Currency Theory (NCT). With some help the entries were refined, corrected or paraphrased. The result is the following triple column.

I am presenting it here for anybody to use as an educational tool in the discussion about the deep flaws of MMT in order to 1) promote what we think is the correct theory of money and banking and 2) promote the necessary legislative changes which are needed to redress the deep systemic flaws of the current money regime.

I am presenting it here for anybody to use as an educational tool in the discussion about the deep flaws of MMT in order to 1) promote what we think is the correct theory of money and banking and 2) promote the necessary legislative changes which are needed to redress the deep systemic flaws of the current money regime.

To be clear, what we propose is the following triple-pronged policy proposal, which can be found on the web site of the International Movement for Monetary Reform:

We propose a transition towards a sovereign money system in which:

All official money – be it cash, money-on-account or new forms of digital currency – is created by a monetary state authority, according to the needs of the economy in a transparent and accountable process.

Money is created free of debt, and is directly spent into the economy via the state by way of government expenditure or directly distributed to the citizens as an equal dividend.

Private banks cannot create official money as credit. They only act as payment service providers and/or financial intermediaries by lending and investing existing official money, which they obtain from savers and investors.

This proposal of course is quite different of what proponents of MMT propose and that is government spending on worthy causes like the Green New Deal by allegedly creating new money and do so till the ‘slack’ is out of the economy and inflation might set in. We think that, based on our understanding how the system currently works, 1) this will lead to deficit spending because spending still has to be compensated through taxes and bonds, and 2) it unconscionably neglects to deal with the issue of money creation in the hands of private commercial banks and its disastrous consequences.

Meanwhile the American people already have a bill on the shelf to implement sovereign monetary reform and it is the 2012 H.R. 2990, the National Emergency Employment Defense Act or NEED Act. With some tweaking this bill can be adopted to solve a large chunk of the severe financial challenges the US Congress is facing to prevent the economy from collapse and citizens from bankruptcy and eviction, all in the context of the COVID-19 pandemic. Once you understand the current monetary system, one cannot but see its solution in sovereign monetary reform.

More critical posts on MMT:

Requesting Evidence for a Crucial MMT Claim

Richard Wolff’s Trajectory beyond MMT into SMR

Introduction to the Problem with Modern Monetary Theory (MMT)

Money and Banking: Assessing overlaps and differences between SMR and MMT

Modern Money Theory revisited – still the same false promise